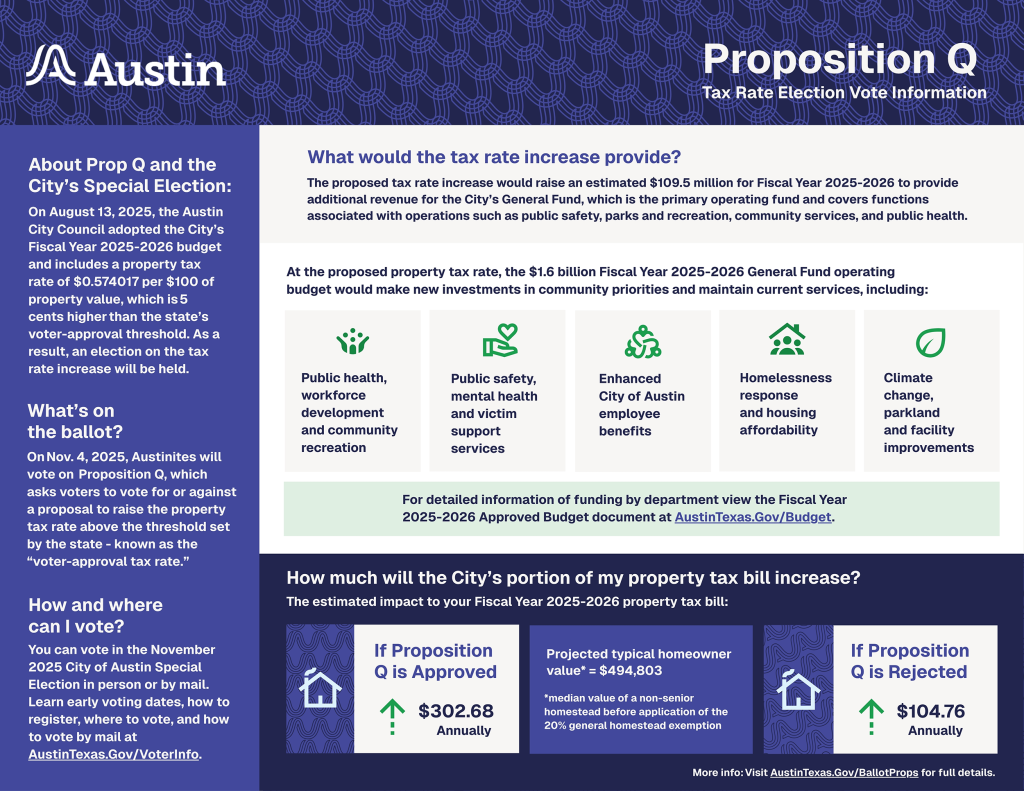

At its August 13, 2025 council budget meeting, the Austin City Council adopted the City’s budget for the 2025-2026 fiscal year. With approval of the budget, the Austin City Council adopted a property tax rate above the voter-approval tax rate, which requires the City of Austin to hold an election on the tax rate increase.

Austinites can vote on this issue (Proposition Q on the ballot) in the November 4, 2025 City of Austin Special Election.

Click image to expand

City of Austin, Proposition Q

THIS IS A TAX INCREASE

Approving the ad valorem tax rate of $0.574017 per $100 valuation in the City of Austin for the current year, a rate that is $0.05 higher per $100 valuation than the voter approval tax rate of the City of Austin, for the purpose of funding or expanding programs intended to increase housing affordability and reduce homelessness; improve parks and recreation facilities and services; enhance public health services and public safety; ensure financial stability; and provide for other general fund maintenance and operation expenditures included in the fiscal year 2025-2026 budget as approved or amended by City Council. Last year, the ad valorem tax rate in the City of Austin was $0.4776 per $100 valuation.

What is a Tax Rate Election?

A tax rate election asks voters of a local area (such as a city or county) to approve or reject a proposal to raise the property tax rate above a threshold set by the state. In Texas, this threshold – known as the “voter-approval tax rate” – is the rate that would raise 3.5% more property tax revenue than last year for the City’s day–to-day operations, as well as the revenue necessary for the City to pay its tax-supported debts in the coming year.

Local governments like the City of Austin need voter approval to raise the property tax rate above this threshold.

What would the tax rate increase provide?

The proposed 5-cent property tax rate increase above the voter-approval rate would generate an estimated $109.5 million in Fiscal Year 2025-2026. The additional revenue would provide for General Fund maintenance and operational expenses. The General Fund is the City’s primary operating fund and covers functions associated with municipal operations such as public safety, parks and recreation, public health, and community services.

At the proposed property tax rate, the $1.6 billion Fiscal Year 2025-2026 General Fund operating budget invests in community priorities and maintains current services.

Items that were identified as community priorities to fund in the upcoming budget year are detailed below.

For more detailed information and a complete picture of funding by department visit Austin City Budget for the Fiscal Year 2025-2026 Approved Budget.

- $35.5 million to expand programs intended to increase housing affordability and reduce homelessness.

-

- $12.0 million to fund up to 350 new units in the Rapid Rehousing program.

- $8.4 million to fund new emergency shelter beds and supportive services, such as case management and housing navigation services.

- $2.0 million in one-time funding to increase the number of available shelter beds in non-City shelters.

- $3.0 million to expand the Housing-focused Encampment Assistance Link (HEAL) initiative, which supports individuals in the transition from shelters into housing by providing rental assistance, move-in assistance, and post-move case management.

- $2.0 million for street outreach efforts to improve engagement with unsheltered individuals, enhance public health response, and connect people to housing and services.

- $1.6 million in one-time funding for landlord engagement and displacement prevention services to help individuals and households remain housed or get quickly rehoused following housing loss.

- $2.3 million for case management and supportive services for Permanent Supportive Housing units scheduled to be operational within the next year.

- $650,000 and six positions for Rapid Rehousing program case management services.

- $2.2 million, including 24 positions, for Homeless Strategies and Operations to expand outreach, improve encampment management, and add administrative capacity to support expanded programs.

- $1.3 million for the Family Stabilization Grant to address economic insecurities, with a focus on housing.

- $100,000 to increase compliance monitoring of the Rental Housing Development Assistance program.

- $27,000 in one-time funding for expanded operations of showers at the Charlie Center, a resource navigation center, in North Austin.

- $22.6 million to improve public safety, expand mental health response, and provide additional supportive services for victims of crime.

-

- $3.1 million for the Expanded Mobile Crisis Outreach Team with the goal of achieving a more comprehensive 24-7 response.

- $1.1 million to expand services at the Sobering Center.

- $2.6 million, including 24 new positions, to operate two additional Austin/Travis County Emergency Medical Services Basic Life Support (BLS) response units.

- $2.5 million, including 22 new positions, to expand the Austin/Travis County Emergency Medical Services mental health crisis response team to respond to low acuity patients.

- $925,000, including eight additional commander positions, to provide oversight of expanding Austin/Travis County Emergency Medical Services operations.

- $896,000, including eight additional Austin/Travis County Emergency Medical Services communications positions, to address growth in the number of 9-1-1 calls.

- $8.3 million in one-time funding for Fire sworn overtime to maintain the 4-person staffing model.

- $1.9 million for community violence interventions and supportive services for victims of crime, including trauma recovery services and mental health treatment for survivors of violent crime.

- $700,000, including $350,000 in one-time funding, for domestic violence shelter operations and supportive services for victims of domestic violence.

- $300,000 in one-time funding for child advocacy services in Williamson County to provide support for children who are victims of and/or witnesses to violent crimes.

- $150,000 in one-time funding to provide navigation services for victims of violence and abuse.

- $260,000, including two positions, to restore funding and staffing for the Austin Police Oversight office to the prior year levels.

- $7.7 million to expand public health services, workforce development, and community recreation opportunities.

-

- $1.9 million in one-time funding for workforce development programs, such as Austin Civilian Conservation Corps and re-entry workforce development.

- $800,000, including four positions, for delivery of community-based HIV/STI testing and treatment services, including low-cost or free same-day testing and treatment in walk-in or mobile environments.

- $150,000 for harm reduction services.

- $50,000 to expand and promote M-Pox and other vaccination programs.

- $1.6 million in one-time funding to provide stability to core public health grants at risk of reduced grant funding.

- $619,000 for Parent Support Specialists at local schools to support families in becoming active participants in the education of their child/children.

- $42,200 in one-time funding for Pre-K classroom start-up costs, such as furniture and classroom materials.

- $550,000 in one-time funding to address food insecurity, such as home-delivered meals for older adults facing economic hardship or physical disability and food pantries at Title I schools.

- $270,000 in one-time funding for financial advocacy programming for at-risk individuals, including older adults and people with disabilities.

- $170,000 to provide support to families with newborns through postpartum nurse visits, education, and referrals.

- $436,000 in one-time funding for Austin Parks and Recreation to expand transportation and recreational programming for older adults.

- $200,000 in one-time funding to purchase additional library materials.

- $186,000 in one-time funding for a bilingual STEM program at the Emma S. Barrientos Mexican American Cultural Center.

- $800,000 in one-time funding for regional animal adoption services, including a mobile location.

- $10.0 million to enhance programs that respond to the challenges of climate change and investments in City parkland and facility improvements.

-

- $6.0 million, including 60 positions, for parks and recreation facility and grounds maintenance needs.

- $450,000 in one-time funding to assess library and recreation facilities high-priority capital improvement projects.

- $375,000 for improved maintenance of youth athletic fields at recreation centers across the city.

- $1.3 million, including three positions, for natural land restoration and wildfire prevention on parkland.

- $1.0 million for wildfire mitigation, prevention, and education efforts.

- $100,000 to assist low-income residents prepare and recover from flooding.

- $440,000 for two positions to enhance historic preservation and City planning efforts.

- $229,000 for two positions to support the implementation of the Austin Climate Equity Plan.

- $300,000 in one-time funding for energy upgrades to City facilities.

- $1.3 million for enhanced City of Austin employee benefits.

-

- $800,000 in one-time funding for a one-time $500 stipend for City of Austin non-sworn employees not eligible for remote work/telework.

- $300,000 for Bad Weather Pay for frontline City of Austin employees.

- $100,000 in one-time funding for part-time temporary City of Austin employee benefits.

- $50,150 for a $2,120 base wage increase for civilian regular employees earning less than $53,000 annually.

- Highlights of additional and continued funding necessary to maintain current service levels for General Fund operations and maintenance are detailed below.

-

- $11.5 million to continue emergency shelter operations at the Marshalling Yard and the 8th Street Shelter.

- $754,000 to provide full-year funding for 12 Austin/Travis County Emergency Medical Services sworn positions and 16 Austin Fire sworn positions added last year for the Canyon Creek Fire/EMS station that opened last year.

- $280,000 for wildfire shelters and equipment to improve the safety of the Austin Fire wildfire response teams.

- $875,000 in one-time funding for the second half of the Austin Fire cadet training class.

- $550,000 in one-time funding for the final phase of replacements of self-contained breathing apparatuses for firefighters.

- $500,000 for five positions for the new Austin Arts, Culture, Music, and Entertainment department to provide administrative and financial oversight.

- $517,000 to provide full-year funding for 20 positions added last year for parks and cemeteries maintenance.

- $125,000 for two pool maintenance positions to support Colony Park pool and other aquatics facilities.

- $400,000 for additional security staffing at library branches.

- $373,000 for five positions for Austin Forensic Science to assist with chain-of-custody activities at the new Forensic Warehouse, which is scheduled to open this year.

- $370,000 for four positions for Austin Animal Services, including two Animal Protection Officers and two administrative manager positions, to meet current service demands.

- $225,000 for two Austin Planning positions to support the current workload; one to assist with district and comprehensive plans and one to support financial functions.

What would be the estimated impact on my City of Austin property tax bill?

If the voters approve Proposition Q, the City estimates the annual increase would be about $302.68 from the previous tax year to the typical Austin property owner’s 2026 annual tax bill with a median homestead assessed value of $494,803.

What happens if voters reject Proposition Q?

If the voters reject Proposition Q, the property tax rate will be reduced to the voter-approval tax rate of 52.4017 cents per $100 value. At that tax rate, the City estimates it will collect $109.5 million less revenue than the amount budgeted for Fiscal Year 2025-2026 General Fund revenue, and the typical Austin property owner’s 2026 tax bill would see an annual increase of $104.76 from the previous tax year, based on a median homestead assessed value of $494,803.

The City Charter requires the City’s annual General Fund Budget to be balanced so projected revenues equal budgeted expenditures. A reduction in projected revenue would require the City to revisit the Fiscal Year 2025-2026 General Fund Budget to rebalance revenues and expenditures.

How can I vote?

You can vote in the November 2025 City of Austin Special Election in person or by mail. Learn early voting dates, how to register, where to vote, and how to vote by mail at austintexas.gov/voterinfo.