Disclaimer

This Frequently Asked Questions (FAQ) is designed to provide general information about the proposal that will be presented in the November 5, 2013 election for the consideration of the registered voters of the City of Austin The publication does not advocate passage or defeat of the measure and is intended for informational purposes only.

Frequently Asked Questions

This Frequently Asked Questions (FAQ) is designed to provide general information about the proposal that will be presented in the Nov. 5, 2013, election for the consideration of the registered voters of the City of Austin. The publication does not advocate passage or defeat of the measure and is intended for informational purposes only.

According to the U.S. Department of Housing and Urban Development, affordable housing is when a household pays no more than 30 percent of its annual income on housing. For more information about the federal definition of affordable housing, visit the U.S. Department of Housing and Urban Development website.

The people who may be eligible to participate in programs funded by the City’s Affordable Housing Bonds are described in the Voter Information Flier. The 2013 Income Limits for the City’s Neighborhood Housing and Community Development Department programs, including the 2006 Bond Program and (if approved) the 2013 Affordable Housing Bond Program can be viewed here. The City expects to provide such funding by partnering with organizations that offer affordable rental and ownership housing and that support the preservation of existing affordable housing.

In 2006, Austin voters approved $55 million in general obligation bonds to support affordable housing. The bonds were used to create and preserve housing options for low-income Austin residents. These housing options included rental and ownership housing as well as home repair programs. The $55 million went to building, retaining, and repairing nearly 2,409 affordable units. Learn more about the projects here.

No. Funding for the City’s affordable housing programs has been provided by other sources, including private developers and other public sources. These sources have been used in conjunction with the City’s 2006 housing bonds.

Developments funded through the City of Austin’s Housing Development Assistance Program can be affordable up to 40 years for rental housing and up to 99 years for ownership housing.

The property tax rate is composed of two parts: the operations and maintenance rate and the debt service rate. The debt service rate is set according to the amount of revenue necessary to make the City’s payments for tax-supported debt, such as voter-approved general obligation bonds.

When voters approve bond propositions, the City does not issue all of the debt immediately. Instead, debt issuances are spread out over several years. By monitoring the annual spending needs and not issuing all the debt at one time, the City can reduce debt service costs and keep the debt service tax rate more stable from year to year.

City Council approved holding a November bond election during the 2012-13 fiscal year, when the City’s debt service rate was 12.08 cents per $100 of taxable property value. The debt service rate was subsequently reduced to 11.71 cents per $100 of taxable property value for the 2013-14 fiscal year. If the 2013 Affordable Housing Bond is approved by voters, the debt service rate is projected to return to 12.08 cents per $100 of taxable property value for the 2014-15 fiscal year. The average cost to the typical (median value) homeowner’s property tax bill is estimated at $8.75 per year over the life of the debt.

For additional tax impact and other financial information, please refer to the City’s budget documents available online at www.austintexas.gov/finance.

The 2013 Affordable Housing Bond Voter Information Flier, which can be viewed here, provides general information about the proposed affordable housing bonds. You may also call (512) 974-7840.

Capital improvement projects range from a new curb ramp or sidewalk to construction of multimillion- dollar facilities, such as public libraries and cultural centers.

The City identifies potential capital improvement projects using technical assessments of infrastructure condition and need, public input received through individual department’s planning efforts, staff input and requests from City Boards and Commissions. The annual project identification and prioritization process typically begins early in the calendar year with each City department conducting an analysis to identify capital project needs for the next five years. Part of this analysis includes the review of spending plans for completing existing capital projects and programs as well as the allocation of General Obligation bond funding to projects that meet the public purpose of bond propositions approved by voters.

These departmental spending and funding allocation plans are then submitted to the Capital Planning Office and the Budget Office of the Financial and Administrative Services Department, which review the projects and compiles a five-year Capital Improvement Program (CIP) Plan. The CIP Committee of the Planning Commission regularly reviews the CIP Plan during its development, at which time citizens have the opportunity to provide comments and feedback. The full Planning Commission gives the five-year CIP Plan final approval. The CIP Plan functions as a planning and budgeting tool, and serves as the basis for the City’s annual Capital Budget.

In September 2012, the City of Austin had about $830 million in net total tax-supported General Obligation bond debt. This is debt that is directly supported by property tax revenue.

Austin's debt per capita is $1,287. The debt-to-assessed value (AV) ratio is 1.24%. This means that the City’s debt is 1.24% of the total assessed value of properties within city limits. These figures are lower than the national median for cities with more than 500,000 people, according to Moody’s data. The national median debt per capita is $1,525 and the median debt-to-AV ratio is 2.2%.

The City has an AAA credit rating, which is the highest credit rating given by the three major credit rating agencies. Credit rating agencies consider four primary factors when rating a municipality’s credit: economy, finances, debt and management.

The City’s credit rating shows that it maintains a good standing with the credit rating agencies and is looked at favorably in how it implements capital programs and structures its debt.

The City’s Annual Budget has two primary components: the Operating Budget and the Capital Budget. The Capital Budget funds major improvements to City facilities and infrastructure, and is based on the first year of needs in the five-year Capital Improvements Program (CIP) Plan. The Capital Improvements Program (CIP) Plan is an annually revised document that guides the City’s investments in public facilities and infrastructure during a five-year time horizon. The Capital Budget is supported through multiple funding sources, including different types of bonds (debt), grants and cash as well as other smaller sources of funding.

The Operating Budget includes personnel costs and annual facility operating costs. It is funded primarily through local property and sales taxes; revenue transfers between departments; licenses, such as building and development fees; franchise fees for a company’s use of the City’s rights-of-way; charges for services; fines and other smaller sources of revenue such as interest on investments.

City Council holds public hearings on the proposed operating and capital budgets and then approves both budgets in August or September for the following fiscal year, which begins Oct. 1.

The Capital Improvement Program is supported by a number of different funding sources, including debt, operating transfers, grants, and various other smaller revenues. The type of funding utilized for a project can vary according to the type of project as well as the department. Debt sources include public improvement bonds (voter‐approved General Obligation bond programs), certificates of obligation, contractual obligations, and commercial paper.

The types of funding used for a project vary based on the type of project and whether the City department or agency overseeing the project is part of the General Government or Enterprise Departments. General Government departments are primarily funded through property and sales tax revenues. Enterprise Government departments, such as Austin Energy and Austin Water Utility, generate revenue from the sale of services (ie: utility rates and user fees) and use this revenue to fund capital improvement projects and operations.

The City currently has four active major bond programs, including 2006, 2010, 2012, and 2013. When a bond program is approved by the voters, the full authorized amount is not appropriated all at once. Instead, it is appropriated in installments in accordance with the prioritization, coordination, and timing of projects over the life of the bond program.

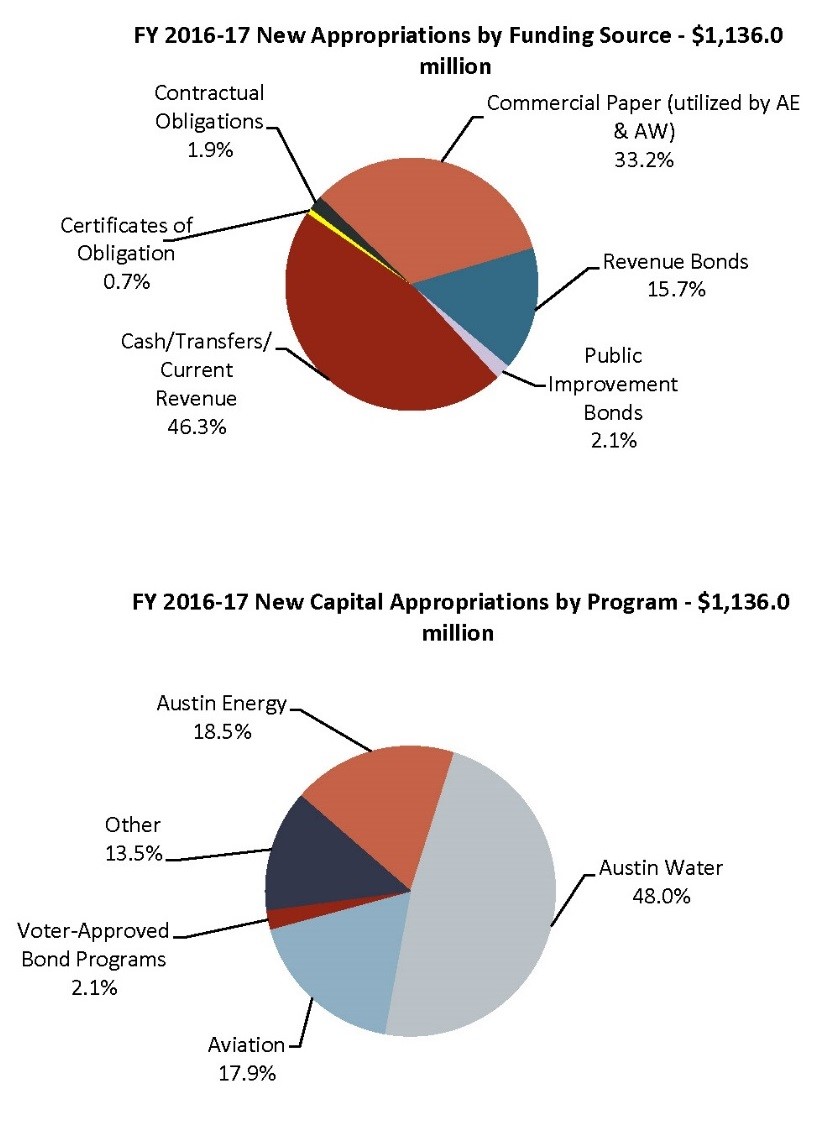

The following chart shows the new appropriations for the proposed FY 16-17 Capital Budget by funding source and program. New appropriations, or allocations of funding, and what the City plans to spend in the fiscal year are different. Full appropriations for capital projects are required for the City to contract professional service providers even though the funds may be expected during the course of multiple fiscal years. Expenditures may span multiple years because some capital projects take several years from design to construction to be completed.

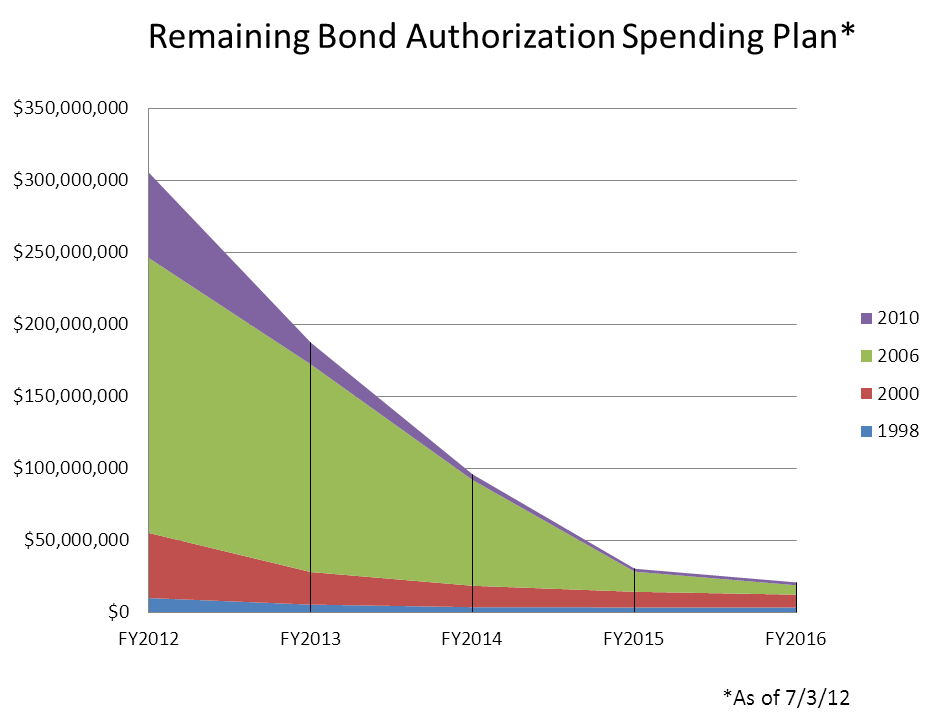

When voters approve bond propositions, they are giving the City authorization to sell bonds (borrow money) to fund long-term capital improvement projects. As of September 2012, the City had about $335 million in unspent bond authorization. Prior to the 2012 bond election, the most recent City of Austin bond elections were held in 1998, 2000, 2006 and 2010.

- In 1998, voters authorized the City to issue $339,740,000 in bonds to fund transportation, parks, public safety, libraries and cultural facilities, and drainage projects.

- In 2000, voters authorized the City to issue $163,400,000 in bonds to fund transportation and open space projects.

- In 2006, voters authorized the City to issue $567,400,000 in bonds to fund transportation, drainage and open space, parks, cultural facilities, affordable housing, the central library and public safety facilities.

- In 2010, voters authorized the City to issue $90,000,000 in bonds to fund transportation and mobility projects.

Based on the information available, more than 70% of the remaining authorized bond funds from the 1998, 2000, 2006 and 2010 bond programs would be spent by the end of FY 14 and about 95% by the end of FY 16.

A seven-member citizen Bond Oversight Committee has been appointed by City Council to review the annual allocation of funds and spending plans for the 2006 and 2010 bond programs as well as future bond programs, including the 2012 Bond Program. The Committee is responsible for helping ensure efficiency, equity, timeliness and accountability in the implementation of voter-approved bond programs.

The interest rate that the City pays on General Obligation bond debt depends on when the debt is issued, but right now interest rates are historically low. The interest rate on the most recent sale of voter-approved debt, in August 2012, was less than 3%. The City has the highest credit rating given by the three major credit rating agencies. The combination of the current market as well as the City’s credit rating results in this low interest rate.

A capital improvement project is any major improvement to City facilities and infrastructure. Projects may include construction and renovation of recreation centers and libraries, acquisition of parkland, repaving of streets, replacement of water and wastewater lines, provision of power for residents and the purchase of new fleet vehicles and IT networks. Collectively, these projects are referred to as the Capital Improvements Program. Capital improvement projects are varied, so some may require years of planning and construction while others may be completed in a shorter timeframe.

The Capital Planning Office provides quarterly updates on the 2006 and 2010 bond programs, and will begin providing updates on the 2012 Bond Program. Those materials may be found by visiting the City’s Bond Oversight Committee webpage.

The City is addressing ways to improve its reporting on the Capital Improvements Program and bond spending.

The City funds its Capital Improvements Program in several ways. One way is through voter-approved General Obligation (GO) bonds. GO bonds give cities a tool to raise funds for capital improvement projects that are otherwise not funded by City revenue, such as roads, bridges, bikeways and urban trails and parks. As a result, GO bonds are typically used to fund capital improvement projects that will serve the community. If voters approve a bond proposition on an election ballot, the City is authorized to sell bonds up to the amount indicated in the proposition language to fund capital improvement projects that meet the public purpose of that bond proposition. For example, in November 2012, voters approved City of Austin Proposition 14, allowing the City to borrow up to $77,680,000 to fund parks and recreation projects.

GO Bonds are backed by the full faith and credit of the City of Austin. This means the City is obligated to pay back the bonds by pledging its ad valorem taxing power, or in other words its ability to collect property taxes, to repay the debt.

The property tax rate is composed of two parts: the Operations and Maintenance rate (O&M) and the debt service rate. The debt service rate is set in order to generate the revenue necessary to make the City’s payments for tax-supported debt. The 2014 fiscal year debt service rate is 11.71 cents for every $100 of assessed property value.

Bond debt can be compared to a home mortgage that is repaid over time, while O&M expenses are like the daily household expenditures that are paid for immediately, such as groceries. Like buying a house, major capital improvement projects, such as park or library improvements, have a long useful life, so their cost is spread out over many years and paid for by current and future citizens who use them. The debt is typically financed over a 20-year period.

When voters approve bond propositions, the City does not issue all of the debt immediately. Instead, debt issuances are spread out over several years according to the annual spending needs of the bond program. By monitoring the annual spending needs and not issuing all the debt at one time, the City can keep the debt service tax rate more stable from year to year.

Capital improvement projects vary widely, so some may require years of planning prior to construction, and others may be completed in a shorter timeframe. Prior to construction, some projects may entail acquisition of land, which may involve complex negotiations.

In some cases, voter-approved bonds are intended to pay only for initial phases of a project, such as preliminary engineering or design, rather than the entire project from start to finish. By allocating funding to the early phases of a project, it enables the project to be eligible for future funding opportunities including federal grants, state grants, or other grants or partnerships while freeing up resources for other projects to move forward as well.

Voter-approved General Obligation bond programs typically overlap because capital improvement projects may take several years to complete from planning to design and construction. As a result, spending may resemble a bell curve, with the largest amount of authorized funding being spent a few years after the bonds are approved by voters and then tapering toward the end of the bond program.

If a bond election is held after all of the previous bonds are spent, the result could be a lull in delivery of capital improvement projects.