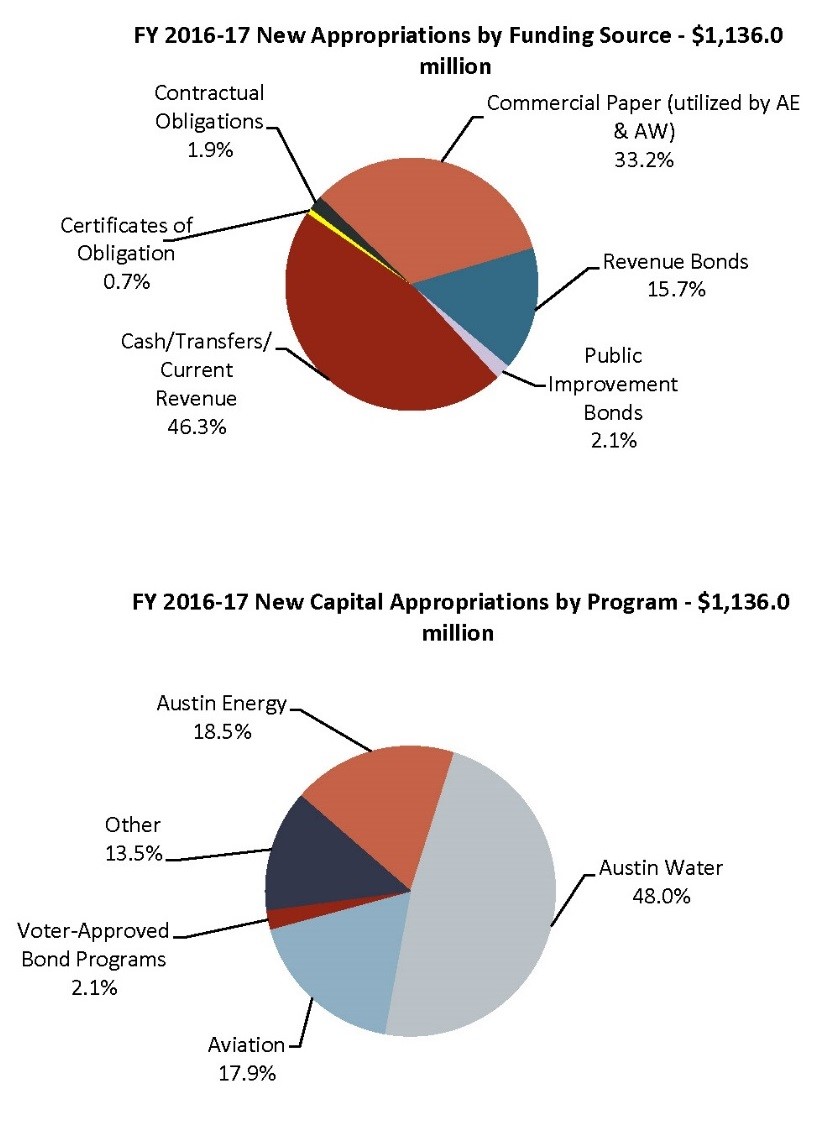

The Capital Improvement Program is supported by a number of different funding sources, including debt, operating transfers, grants, and various other smaller revenues. The type of funding utilized for a project can vary according to the type of project as well as the department. Debt sources include public improvement bonds (voter‐approved General Obligation bond programs), certificates of obligation, contractual obligations, and commercial paper.

The types of funding used for a project vary based on the type of project and whether the City department or agency overseeing the project is part of the General Government or Enterprise Departments. General Government departments are primarily funded through property and sales tax revenues. Enterprise Government departments, such as Austin Energy and Austin Water Utility, generate revenue from the sale of services (ie: utility rates and user fees) and use this revenue to fund capital improvement projects and operations.

The City currently has four active major bond programs, including 2006, 2010, 2012, and 2013. When a bond program is approved by the voters, the full authorized amount is not appropriated all at once. Instead, it is appropriated in installments in accordance with the prioritization, coordination, and timing of projects over the life of the bond program.

The following chart shows the new appropriations for the proposed FY 16-17 Capital Budget by funding source and program. New appropriations, or allocations of funding, and what the City plans to spend in the fiscal year are different. Full appropriations for capital projects are required for the City to contract professional service providers even though the funds may be expected during the course of multiple fiscal years. Expenditures may span multiple years because some capital projects take several years from design to construction to be completed.