Proposition Summary

Proposition A: Approving the City’s property tax rate and dedicating 8.75 cents of the operations and maintenance portion of the tax rate for Project Connect, a high-capacity transit system. See the Project Connect website for up-to-date information about next steps and ways to get involved.

Proposition A asked voters to vote for or against approving the maintenance and operations portion of the City’s property tax rate and dedicating 8.75-cents towards the implementation of Project Connect, and ensuring that the initial investment is completed.

Federal funding is anticipated to provide approximately 45% of the program’s estimated $7.1 billion capital cost. The property tax revenue will provide funding for the rest of the capital cost plus operations and maintenance of the transit system once built. The initial investment also includes $300 million for transit-supportive anti-displacement housing strategies.

The dedicated property tax revenue, along with Capital Metro revenue and Federal funding, will be directed to a new, independent government organization called the Austin Transit Partnership. This organization will oversee, finance and implement Project Connect.

- See the Proposition A Contract with Voters here (Council Resolution No.20200807-003).

- See the Proposition A Election Ordinance here.

Ballot Language

The Proposition appeared on the official ballot in substantially the following form, and the ballot was prepared to permit voting "for" or "against" the Proposition:

"Approving the ad valorem tax rate of $0.5335 per $ 100 valuation in the City of Austin for the current year, a rate that is $0.0875 higher per $100 valuation than the voter-approval tax rate of the City of Austin, for the purpose of providing funds for a citywide traffic-easing rapid transit system known as Project Connect, to address traffic congestion, expand service for essential workers, reduce climate change emissions, decrease traffic fatalities, create jobs, and provide access to schools, health care, jobs and the airport; to include neighborhood supportive affordable housing investments along transit corridors and a fixed rail and bus rapid transit system, including associated road, sidewalk, bike, and street lighting improvements, park and ride hubs, on-demand neighborhood circulator shuttles, and improved access for seniors and persons with disabilities; to be operated by the Capital Metropolitan Transportation Authority, expending its funds to build, operate and maintain the fixed rail and bus rapid transit system; the additional revenue raised by the tax rate is to be dedicated by the City to an independent board to oversee and finance the acquisition, construction, equipping, and operations and maintenance of the rapid transit system by providing funds for loans and grants to develop or expand transportation within the City, and to finance the transit-supportive anti-displacement strategies related to Project Connect. Last year, the ad valorem tax rate in the City of Austin was $0.4431 per $100 valuation."

Project Overview

Project Connect is a comprehensive transit plan including new rail service, new and expanded bus service with an anticipated all-electric bus fleet, new park and rides and more.

New Rail System

The planned system includes 27 miles of service and 31 stations, along with the following lines:

- Orange Line (initial investment: from North Lamar and U.S. 183 to Stassney Lane): To connect North and South Austin

- Blue Line (from North Lamar and U.S. 183 to downtown and the Austin Bergstrom International Airport): To offer service to the airport

- Green Line (from downtown to East Austin’s Colony Park): New commuter rail service

Transit Tunnel Under Downtown

Light rail is proposed to travel underground downtown. The City expects operating rail service beneath the streets to increase the system’s travel time reliability and to be safer than operating at street level.

Four New Rapid Bus Routes

- The Gold Line (from the Austin Community College (ACC) Highland Campus to South Congress and Ben White Boulevard): A MetroRapid service that could eventually be converted to light rail as a part of the Project Connect System Plan.

- Expo Center (from East Austin to the University of Texas and downtown)

- Pleasant Valley (from Mueller to the Goodnight Ranch Park & Ride)

- Burnet (from The Domain to Menchaca and Oak Hill)

New Facilities

The plan includes as many as nine new Park & Ride facilities at Four Points, Loop 360, ACC Highland, Delco Center, Expo Center, Wildflower Center, Goodnight, McKinney Falls, MetroCenter, and a new transit center at the Eastside Bus Plaza.

New Circulators

The plan proposes 15 new neighborhood circulators, on-demand pickup and drop-off to locations within zones. Circulators provide first-mile/last-mile service and connections to transit stations and other destinations.

Transit-Supportive Anti-Displacement Funds

The tax rate includes $300 million for transit-supportive anti-displacement housing strategies. These strategies will be guided by the Austin Strategic Housing Blueprint and Federal Transit Administration, and the needs of the communities for housing along the Project Connect System Plan.

Financial and Tax Bill Impact

The City of Austin is one of multiple taxing entities to which property owners pay property taxes annually. Approval of Proposition A dedicates 8.75 cents of the City’s property tax rate revenue to the Austin Transit Partnership to fund implementation of Project Connect. The Project Connect portion of the City’s property tax rate will become part of the City’s property tax rate each year.

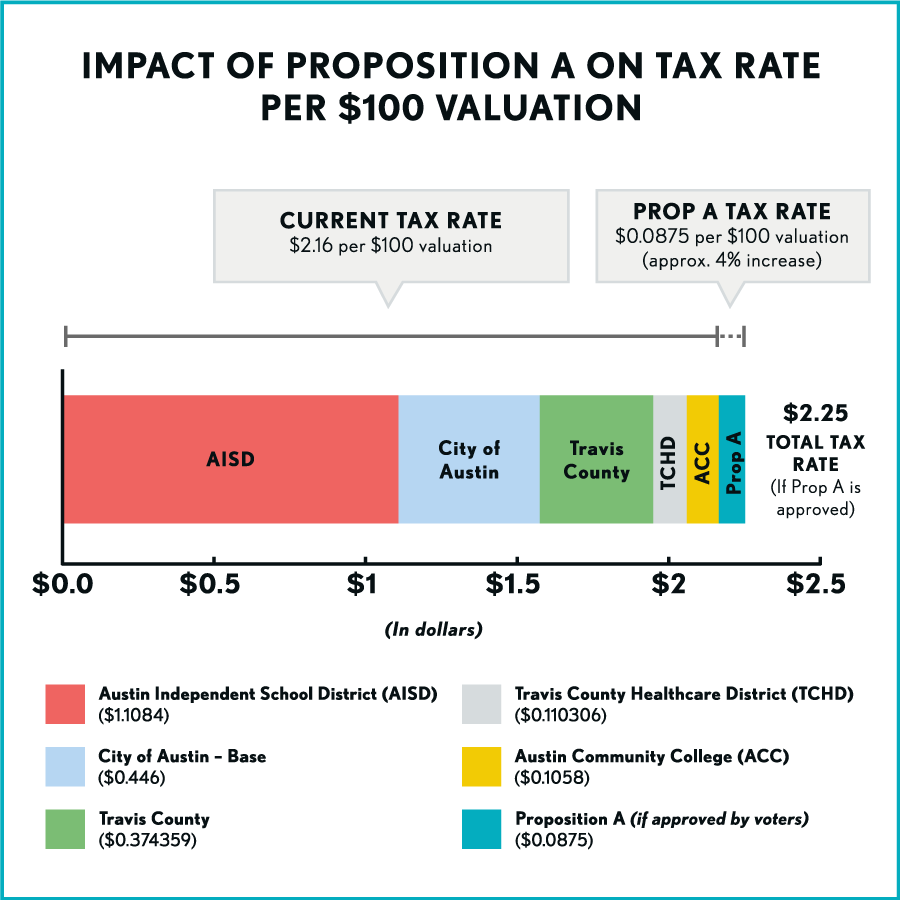

For the typical Austin homeowner, the tax bill for the all taxing jurisdictions is based on a tax rate of $2.16 per $100 of value. Proposition A will increase the tax rate by 8.75 cents, or approximately 4%; the impact on total tax bill is also approximately 4%. (See charts below.)

The anticipated annual tax bill impact is based on taxable home value. Taxable home value is the appraised value of a home after property tax exemptions have been applied, such as the homestead exemption or the senior exemption. The estimated tax bill impact of passage of Proposition A is an approximation-based Fiscal Year 2020/2021 property tax rate. This property tax rate reflects assumptions about market and economic conditions and may be subject to change.

2020 Austin Median Home Value (after homestead exemption): $326,368

| Home Value | Anticipated Annual Impact | Anticipated Monthly Impact |

|---|---|---|

| $250,000 | $219 | $18.23 |

| $325,000 | $284 | $23.70 |

| $500,000 | $438 | $36.46 |

| $750,000 | $656 | $54.69 |

The total tax rate will change from $2.16 per $100 valuation to $2.25 per $100 valuation. The graphic below shows the Proposition A tax rate impact, based on approved rates for Austin ISD ($1.1084), City of Austin ($0.446), Travis County ($0.374359), Travis County Healthcare District ($0.110306), and Austin Community College ($0.1058).

View a property’s taxable value:

- For properties in Travis County, see the Travis Central Appraisal District website.

- For properties in Williamson County, see the Williamson Central Appraisal District website.

- For properties in Hays County, see the Hays County Central Appraisal District website.