What are Homestead Preservation Districts (HPDs)?

The Texas Legislature created HPD statutes in 2005, offering cities certain tools to preserve affordability as they grow. These districts use tools like Tax Increment Reinvestment Zones, Land Trusts, and Land Banks to prevent the involuntary loss of homesteads and support long-term affordability in neighborhoods experiencing economic growth and rising housing costs.

Under Chapter 373A of the Texas Local Government Code, a city may establish an HPD if the area meets the outlined criteria, including requirements for median family income (MFI), total population, and overall poverty rate. Once an HPD is designated, the city may choose to implement one or more of the available tools to promote and protect affordable housing.

The Austin Strategic Housing Blueprint, adopted in 2017, specifically recommends expanding the use of HPD-related mechanisms to advance the City’s long-term affordable housing goals.

Austin’s Homestead Preservation Districts

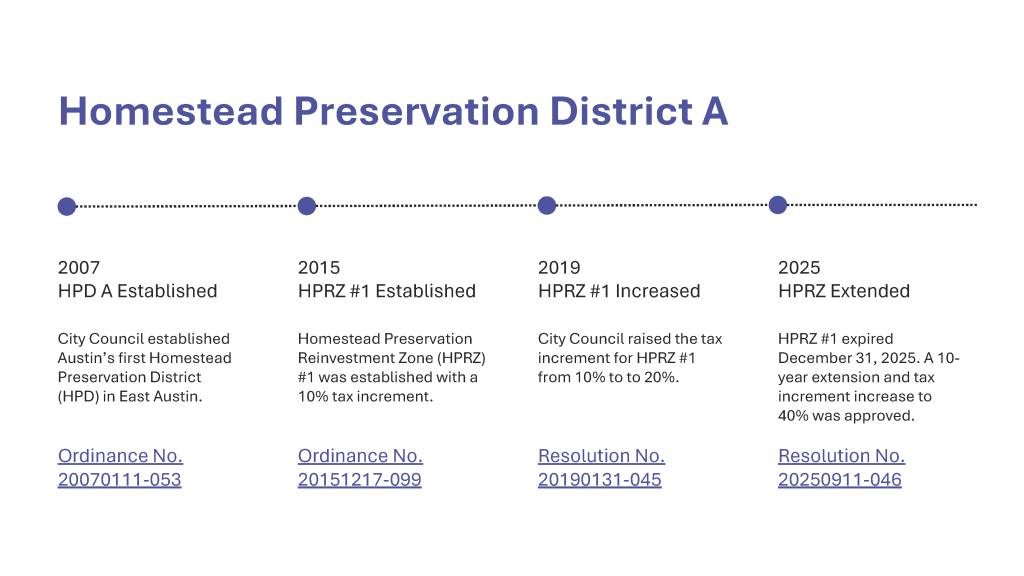

HPD A (2007)

The City of Austin established its first Homestead Preservation District, named HPD A, in 2007. In 2015, City Council created Homestead Preservation Reinvestment Zone (HPRZ) #1 to support affordable housing efforts within HPD A. This is a type of Tax Increment Reinvestment Zone specifically for an HPD. The zone initially dedicated 10% of the tax increment generated in the district to affordability initiatives (Ordinance No. 20151217-099). In 2019, Council increased the increment to 20% (Resolution No. 20190131-045).

HPRZ #1 was scheduled to expire on December 31, 2025. In September 2025, Council approved a 10‑year extension and increased the tax increment from 20% to 40% (Resolution No. 20250911-046).

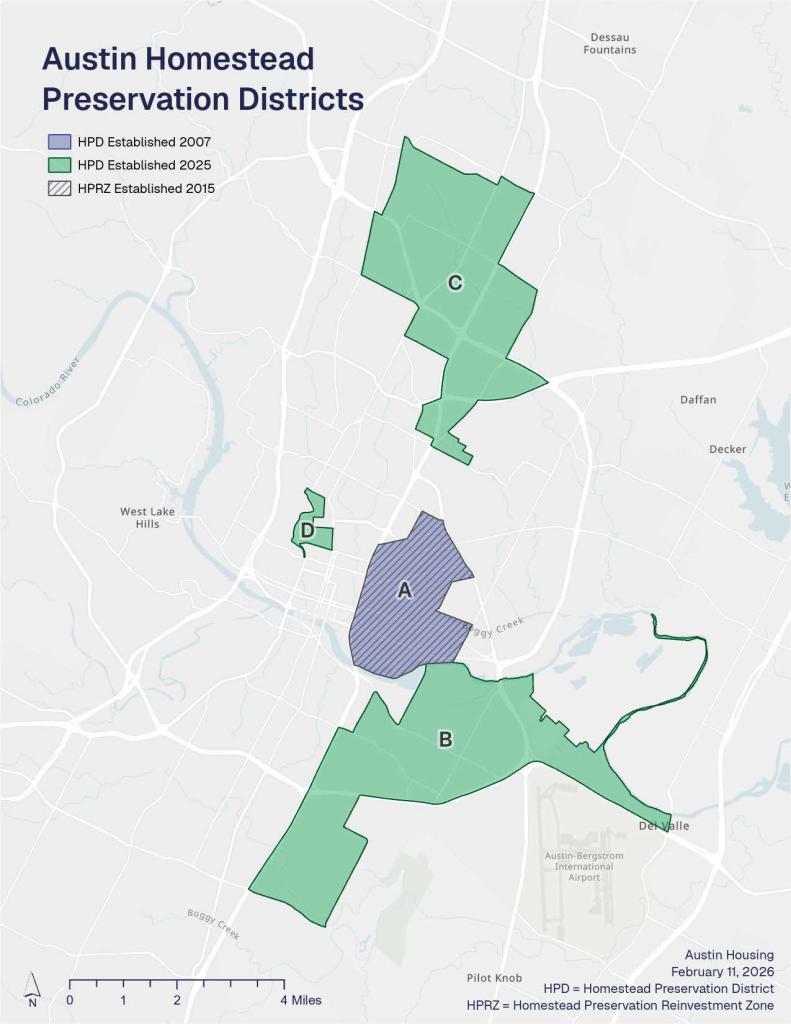

HPDs B, C, and D (2025)

Even though the City considered adding others, Austin was unable to meet the state criteria to establish new HPDs between 2010 and 2023. Legislation that would have allowed Austin to continue to qualify for the creation of new HPDs was vetoed by Governor Abbott in 2017. In 2023, House Bill 4559 updated the eligibility criteria, making Austin once again eligible to establish new HPDs.

In response, City Council directed staff to prepare draft ordinances for new HPDs in areas meeting the updated criteria and to study the feasibility of an HPD in West Campus (Resolution No. 20250911-047).

On November 20, 2025, City Council approved all three new Homestead Preservation Districts:

- HPD B in Southeast Austin

- HPD C in North Austin

- HPD D in West Campus

City Council also directed staff to begin exploring the feasibility of establishing additional reinvestment zones in these areas.

Tools for Homestead Preservation Districts

Once established, HPDs permit the use of three regulatory mechanisms to support affordability in the districts:

- Homestead Preservation Reinvestment Zones (HPRZs)

- Homestead Land Trusts

- Homestead Land Banks

Austin has explored the feasibility of all three tools, including a 2024 study of land banking and land trust options directed by City Council Resolution No. 20240404-067. At this time, the City is prioritizing Homestead Preservation Reinvestment Zones, which are the most effective and applicable tool for Austin’s current housing, market, and funding landscape.

Homestead Preservation Reinvestment Zones

Homestead Preservation Reinvestment Zones (HPRZs) are a type of Tax Increment Reinvestment Zone or Tax Increment Financing model, which can be set up under the Homestead Preservation District to ensure property tax dollars from economic development are reinvested in affordability for that area.

Specific requirements for spending the funds generated through an HPRZ include:

- 100% of tax increment revenue must benefit households at or below 70% MFI

- At least 50% must benefit households at or below 50% MFI

- At least 25% must benefit households at or below 30% MFI

- At least 80% must be spent on project costs (land, construction/rehab, and related infrastructure directly related to affordable housing)

- No more than 10% may be used for municipal administration

- No more than 10% may be provided to land banks or CHDOs for administrative activities

- All assisted housing must carry a minimum 30‑year affordability period

The funds must be used for building improvements, renovations, and new construction. Depending on the established financing plan for the HPRZ, these funds can be spent through various housing programs, including but not limited to:

Austin’s high‑growth environment makes HPRZs well‑suited for capturing value from new development and directing it toward affordability. HPRZ #1 in HPD A has supported the creation of hundreds of affordable units in developments such as The RBJ, The Works III at Tillery, The Ivory, and Santa Rita Courts. The City is currently assessing the feasibility of establishing additional HPRZs in HPD B, HPD C, and HPD D.

Homestead Land Trusts

A city or county may designate one or more Homestead Land Trusts to operate within HPDs, which are based on the community land trust model. These nonprofit entities acquire and hold land to preserve long‑term affordability. By separating land ownership from homeownership, land trusts reduce the cost of purchasing a home and ensure that homeowners pay property taxes only on the structure, not the land.

A Homestead Land Trust operating in an HPD must lease or sell housing units to households at or below:

- 70% Median Family Income (MFI) for all units

- 50% MFI for at least 40% of units

- 30% MFI for at least 10% of units

Austin already has established community land trusts, including the Austin Community Land Trust (ACLT) and other private nonprofit CLTs. Because these organizations already provide long-term affordability tools citywide, the City is not currently pursuing the creation of a Homestead Land Trust specifically under Chapter 373A.

Homestead Land Banks

A Homestead Land Bank allows the city to purchase and hold eligible unimproved land or land ordered sold through tax foreclosure for the purpose of creating affordable housing within the district. Land held in a Homestead Land Bank may be sold to qualified developers with deed restrictions requiring long‑term affordability.

Affordability requirements vary between rental and ownership and include:

- For homeownership:

- All homes sold to households at or below 80% MFI

- At least 25% sold to households at or below 60% MFI

- For rental housing:

- All units rented to households at or below 60% MFI for at least 20 years

- At least 40% rented to households at or below 50% MFI

- At least 20% rented to households at or below 30% MFI

City staff’s 2024 analysis of land bank options found that adopting a Homestead Land Bank under Chapter 373A would make the City ineligible to use the Urban Land Bank Program under Chapter 379E, which offers broader geographic flexibility. Land banks are also most effective in cities where vacancies and disinvestment are the main challenges. Austin’s current high-growth environment is less suitable for capitalizing on the core benefits of a land bank. For these reasons, the City is not exploring Homestead Land Bank at this time.

Contact Us

For more information, to submit comments, or to ask questions, please contact us through the Austin Housing Policy Contact Form or call 512-974-3100.