Low-income housing tax credits (LIHTC) will help offset costs for future affordable housing developments

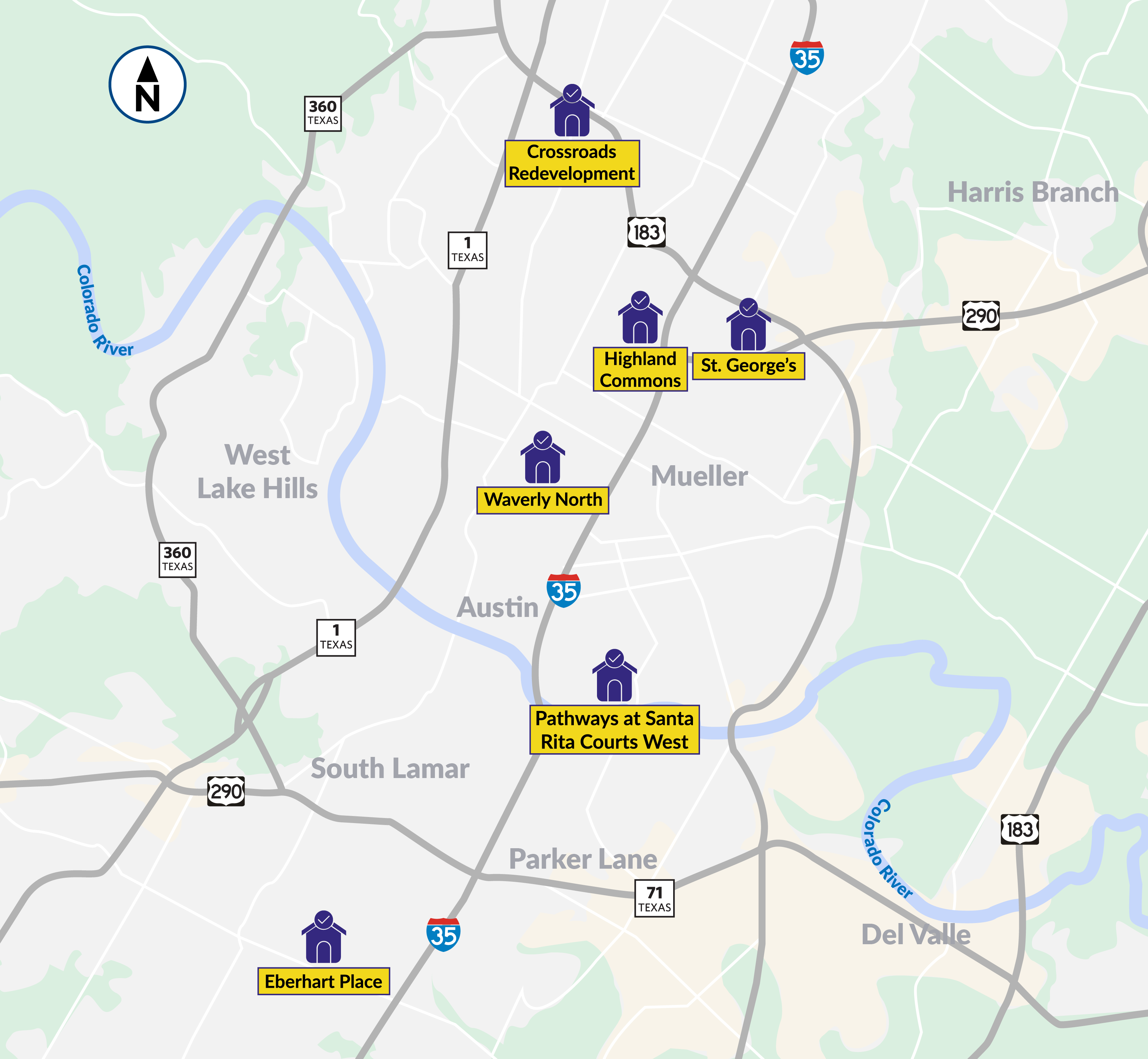

Caption: Graphic courtesy of the City of Austin Housing Department.

AUSTIN, TX – The City of Austin Housing Department is pleased to announce that six local affordable housing developments have received resolutions of support from the Austin City Council to apply for 9% low-income housing tax credits from the State of Texas.

Getting these resolutions is the first step developers must take before they can formally apply to the state agency which administers the program, the Texas Department of Housing and Community Affairs (TDHCA), and compete in this annual process.

“These resolutions of support push the proposed communities one-step closer to in their competitive bids for the 9 percent tax credits,” explains Mandy DeMayo, Interim Director for the Housing Department. “Tax credit developments help ease the shortage of affordable rental housing, attract private investment in affordable housing, and create jobs with an economic multiplier effect that lasts beyond the end of construction.”

Typically, the competitive process begins in January and awards are made by the TDHCA in July. The projects are generally completed within 2 years. To be eligible for the 9% LIHTC, developers are required to obtain a supportive resolution from the City Council as part of their application. City Council resolutions are submitted with each development’s tax credit application to the TDHCA.

Projects that receive this award must meet eligibility for at least 30 years after project completion, with awarded projects typically electing to provide 45 years of affordability, keeping rental units rent restricted and available to low-income tenants. Once this period ends, the properties remain under the control of the owner.

“The 9 percent tax credits play a pivotal role in the development of affordable housing and ensure these communities stay affordable for several decades. The added benefit is that they help create jobs which has a long-term economic boost,” explains James May, Housing and Community Development Officer for the Housing Department.

Resolutions of support

City staff received requests for resolutions from eleven LIHTC Developers in December 2024. Since that time, five of the developments withdrew after their developers chose not to proceed with the full application. As a result, only six developments were considered on the agenda. The six developments that received a resolution of support are as follows:

Pathways at Santa Rita Courts West

Pathways at Santa Rita Courts West is located in District 3 at or near 2210 E. 2nd St. The proposed development is in a displacement risk area and is a rehabilitation of an existing affordable housing community. An affiliate of the Austin Affordable Housing Corporation will be the sole member of the general partner and the landowner, thereby allowing for a full property tax exemption. The rehab calls for the creation of 96 affordable units.

-

10 units will be affordable at or below 30% Median Family Income (MFI);

-

39 units will be affordable at or below 50% MFI; and

-

47 units will be affordable at or below 60% MFI.

Waverly North

Waverly North is located in District 9 at or near 3710 Cedar St. If awarded, tax credits will be used to offset costs for the rehabilitation of an existing community. The community is in a high opportunity area and within half a mile walking distance of high-frequency transit. Plans call for the development of 76 affordable units.

-

17 units will be affordable at or below 30% Median Family Income (MFI);

-

20 units will be affordable at or below 50% MFI;

-

27 units will be affordable at or below 60% MFI; and

-

12 units will be affordable at or below 80% MFI.

Crossroads Redevelopment

Crossroads Redevelopment is located in District 7 at or near 8801 McCann Dr. If awarded, tax credits will be used to finance (or offset construction costs) the rehabilitation of an existing affordable housing community that will result in the creation of 130 supportive housing units. The community will be located within a half mile of high frequency transit.

-

26 units will be affordable at or below 30% MFI;

-

94 will be affordable at or below 50% MFI; and

-

10 will be affordable at or below 60% MFI.

Eberhart Place

Eberhart Place (At-Risk Set-Aside) is located in District 2 at or near 808 Eberhart Ln. The proposed development is in a displacement risk area and is a rehabilitation of an existing affordable housing community. If awarded, tax credits would be used to offset costs and rehabilitate 38 units for senior living.

-

8 units will be affordable at 30% Median Family Income (MFI);

-

16 units will be affordable at 50% MFI; and

-

14 units will be affordable at or below 60% MFI.

St. George’s

St. George’s Court (At-Risk Set-Aside) is located in District 4 at or near 1443 Coronado Hills. If awarded, tax credits will be used for the rehabilitation of an existing affordable housing community which would rehabilitate 60 units for senior living. The community is in a displacement risk area.

-

7 units will be affordable at or below 30% Median Family Income (MFI);

-

24 units will be affordable at or below 50% MFI; and

-

29 units will be affordable at or below 60% MFI.

Highland Commons

Highland Commons is located in District 4, at or near 618 E. Highland Mall Blvd. The proposed development is in a high opportunity area and within half a mile of high-frequency transit. Plans are to create 96 affordable units.

-

10 units will be affordable at or below 30% Median Family Income (MFI);

-

39 units will be affordable at or below 50% MFI; and

-

47 units will be affordable at or below 60% MFI.

Further details on each development can be found in the RCA and backup materials.

How LIHTC works

LIHTC is a federal program, created by the Tax Reform Act of 1986, that provides tax incentives to build or renovate affordable rental housing. The program is administered by the Internal Revenue Service (IRS), who funnels these tax credits (to the tune of about $10 billion in annual budget authority …) down to state housing finance agencies to distribute/issue.

The Texas Department of Housing and Community Affairs (TDHCA) allows housing developers to take a dollar-for-dollar federal tax credit to offset up to either 4 percent or 9 percent of its federal tax liability in exchange for building low-income rental housing projects. The 9 percent tax credit is awarded through a competitive process. These credits typically subsidize 70 percent of the unit costs and support new construction without any additional federal subsidies.

Each developer applying for the 9% tax credits must meet a series of criteria that are set by both the city and the state.

Proposed residential developments are awarded tax credits based on the TDHCA score received within their region. The TDHCA has divided Texas into 11 regions. Austin is in Region 7, which includes Travis County and the surrounding counties. Additional information can be found in the Housing Department memo.

"Historically, Region 7 has only received 2 direct awards per year. With the increased allocation, we are excited to see a potential third award prior to the collapse as well as two very competitive developments in the At-Risk Set Aside category this year," May says.

###

About the City of Austin Housing Department

The City of Austin Housing Department provides equitable and comprehensive housing solutions, community development, and displacement prevention services to enhance the quality of life of all Austinites. To access affordable housing and community resources, visit www.austintexas.gov/housing.